People Matters HR Covid-19 Briefing 18th March 2020.

Know the symptoms

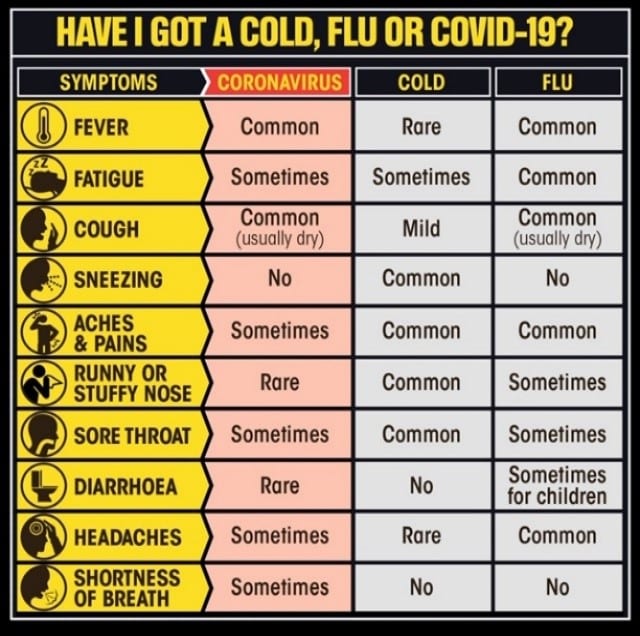

Everyone was encouraged to know the most common symptoms of Covid-19:

- New continuous cough and/ or

- High temperature.

- Difficulty breathing.

For most people, it was a mild illness.

Those at greater risk:

- Underlying conditions (Such conditions as diabetes, cancer, pneumonia, lung disease).

- Weakened immune symptoms.

- Respiratory conditions.

- Some neurological conditions.

- Elderly, above 70.

- Pregnant.

It was advised that those that are above 70, with chronic illness or pregnant should be aware of social distance and were advised to take 12 weeks of self-isolation.

Hygiene measures were enforced, including washing hands with soap, using kitchen roll, hand sanitiser, and antibacterial surface cleaners. Non-compliance with basic hygiene was to be reported and taken seriously.

SSP Updates

SSP was £94.25/ week but rose to £95.85/ week from 6th April 2020.

SSP was extended on a temporary basis to cover:

- Individuals who were not ill but were unable to work because they had been advised to self-isolate in line with Government guidance.

- SSP was payable from day 1 instead of day 4 for affected individuals.

- People advised to self-isolate for COVID-19 could obtain an alternative to the fit note by contacting NHS111 rather than visiting a doctor. This could be used by employees where employers required evidence. Further details were to be confirmed.

- Those not eligible for SSP (e.g., the self-employed or people earning below the Lower Earnings Limit) could now more easily make a claim for Universal Credit or Contributory Employment and Support Allowance.

Read the Charles Russell speech online

Reimbursement:

The Government planned to help those with 250 employees or less as of date 28 February 2020 by refunding eligible SSP costs as follows:

- The refund covered up to two weeks per eligible employee who had been off work because of COVID-19.

- Employers could reclaim expenditure for any employee who had claimed SSP (according to the new eligibility criteria) as a result of COVID-19.

- Employers were to maintain records of staff absences but were not required to obtain GP fit notes. An alternative fit note would be available shortly through NHS111.

- The eligible period for the scheme commenced from 13th March 2020.

Self-isolation and Absence

If someone lived alone and had symptoms, they self-isolated for 7 days.

Self-isolation was advised for all those within the same household for 14 days if someone within the household showed symptoms or was diagnosed.

If someone within the household began displaying symptoms during the 14-day isolation period, they began a 7-day self-isolation from the day the symptoms began.

Returning from overseas:

Member of staff had confirmed Covid-19

- Closure of the workplace was not recommended.

- Cleaning of all communal areas.

- The company was to be contacted by the PHE local Health Protection Team. They identified any risk and provided advice or precautions that should be taken.

- Staff within the building should not have panicked and if not close contact with the confirmed case has been had, they could continue to attend work.

- Those that have had close contact were to be advised to self-isolate for 14 days and remain in contact with the Health Protection Team. During this time, if symptoms occurred, they must ring NHS 111.

Pregnant employees

Pregnant workers were considered to be vulnerable and were advised to self-isolate for up to 12 weeks.

If the employee self isolated they were entitled to SSP from day 1 for up to 28 weeks.

If the employer told them to isolate they were entitled to full pay.

The SSP could be reclaimed for the first 14 days.

Short time working/Lay off

As per your contracts of employment, it entitled you to make layoffs. This allows the employer to reduce the amount of hours and pay or lay employees off unpaid. If this is not in the contract of employment, the employer has no contractual right to lay off with no pay and this must be paid. However, consultation with staff is an avenue to seek, to explain the company situation if this is not the case. People Matters contracts should contain the clause and allow you to put your staff on short term working or lay them off.

Employees are entitled to guarantee pay during lay off or short-time working. The maximum they can get is £29 a day for 5 days in any 3-month period, which is a maximum of £145.

- If they earned less than £29 a day they would receive the normal daily rate.

- Whether they were part-time, entitlement was worked out proportionally.

Not paying guarantee pay counts as an unlawful deduction from wages.

An employee could apply for redundancy and claim redundancy pay if they would have been laid off without pay or put on short-time and receive less than half a week’s pay for:

- 4 or more weeks in a row;

- 6 or more weeks in a 13-week period.

There was a process to apply for this:

- Write to the employer to claim redundancy within 4 weeks of the last day of the lay-off or short-time period.

- The employer has 7 days to accept the claim or give a written counter-notice.

- If the employer does not give a counter-notice, it is assumed the redundancy claim is accepted.

- A counter-notice means the employer expects work will soon be available. It must start within 4 weeks and must last at least 13 weeks.

The employee must resign to claim redundancy pay. This must be within 3 weeks of the written notice for the claim for redundancy pay, providing no counter-notice is given.

If you wished, you could allow them to find work elsewhere.

They may also have qualified for Universal credit or JSA.

The Government were looking into assisting businesses and if layoffs had to occur. They suggested that Universal Credit may have been used to cover the loss of earnings.

Other options:

Working from home

Think about cybersecurity, monitoring performance, access, programmes and systems to assist the function of the company.

Lone working policy and support.

Holidays

Ask staff to take some holiday to cover any reduced wages.

Parental Leave

This is an option if schools close. This is however unpaid, 4 weeks per year, per child in blocks of weeks. This may change to help support parents.

If schools also close and parents need to take time off from work, there is no right for this to be paid currently. Therefore, they could use holiday pay or it would remain at company discretion.

- Stop all recruitment.

- End any zero hours and those in the probationary period as there is no risk.

- Reduce pay by agreement to save money.

- Redundancy.

Do not presume that those under two years’ service do not pose a risk. Discrimination cases and wrongful dismissal can still be raised.

Frequently asked questions

Do we now pay from day one SSP?

Yes you pay SSP or contractual sick pay from day 1 but only if they are self isolating or its Covid 19 – not for a broken leg.

Do we pay for sick persons and if it’s only their family that’s sick?

If their family are sick they must self isolate for 14 days and you are paid SSP or contractual.

What if the person lives alone?

If they live alone they must self isolate for 7 days from when the symptoms started and they get SSP.

So anyone who is self-isolating gets sick pay?

Yes.

Do they have to provide proof? Or self certify?

They will be able to complete a form by contacting 111 which is to be used. This is instead of a “Fitness to Work” note.

Same rate SSP as usual?

Yes

Maximum days we have to pay?

No difference to normal 28 weeks.

How much can we claim back from the government?

The first two weeks SSP can be claimed back from the government

What if they come back to work then go off again?

It looks like you pay it again.

Are the rules same for hourly and salaried pay?

Yes.

Do people report sick as normal?

Yes use your normal policy to report sick or self isolation

What if schools are closed and they have to go off for child care – is this unpaid parental leave?

At the moment this is unpaid parental leave up to four weeks per year per child, they could use holidays, but there could be changes to government policy. Watch this space.

Do they have to provide proof of school closure?

If you want them to, they should.

Parental Leave – are the rules changing? How do we decipher between sick and parental?

If the parent has to self isolate to look after family then they get ssp. If it is just a school closure its unpaid parental leave.

Is layoff is that covered by government?

No the employer pays lay off pay.

What about booked holidays staff no longer require?

They should cancel their holidays with their employer, however they should be reminded that they should not save them up.

Can I force my staff to take leave?

Yes, but you need to give them twice as much notice as you want them to take off eg two weeks advanced notice to take one week off.

What is social distancing, what are the implications?

Stop non-essential contact with others, Work from home where you can, Stop all unnecessary travel.

This kind of social distancing is said to be very important for the over 70s, those with underlying conditions and pregnant women.

The advice is those with the most serious health conditions should be largely shielded from all social contact for up to 12 weeks.

So do I get paid or ssp?

If you have symptoms or have been told to self to self isolate you get ssp.

I work in hospitality, what happens if the government tells us to close?

There is no clear answer to this. If you close and send your staff home you may have to pay them in full. You will need to keep your eyes open for this answer.

I’m worried about my business due to these pressures, who can I speak to?

There is an HMRC Coronavirus helpline: 0300 456 3565.