New Furlough Scheme

The Government have listened and the new Furlough Scheme has moved forward to 1st July 2020.

Businesses will have the flexibility to bring furloughed staff back part time. You can decide the hours and shift patterns staff will work on their return, which might help with social distancing and keeping staff skills up to date, however you will be responsible for paying their wages while in work.

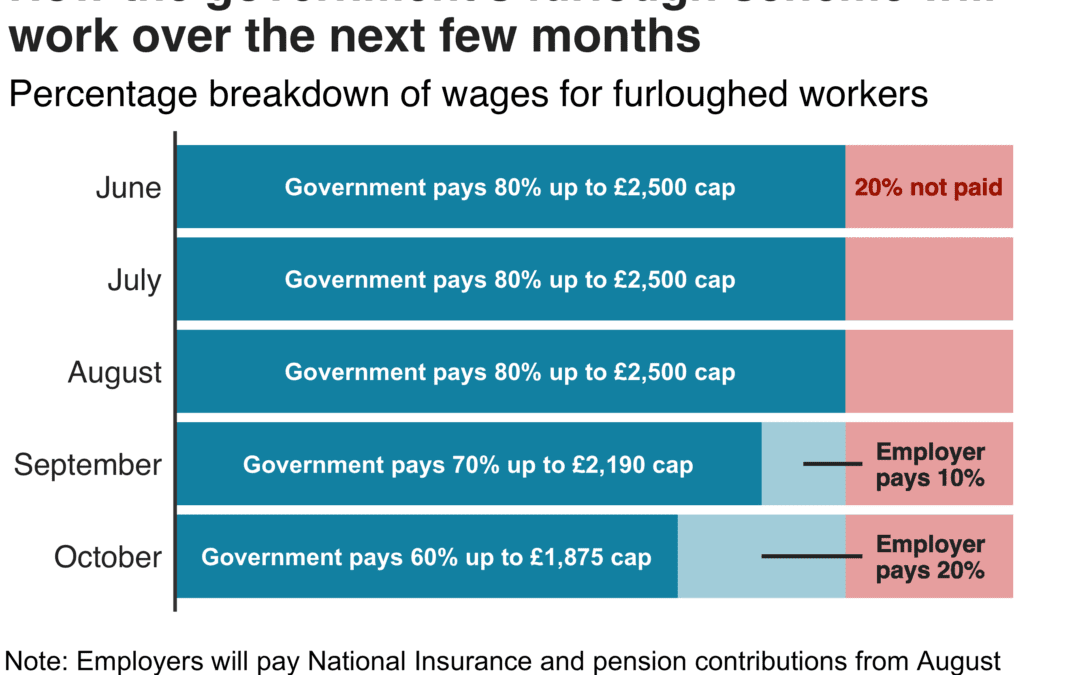

From August, the level of government grant provided through the job retention scheme will be begin to taper down as people return to work.

That means that in June and July the government will continue to pay 80% of people’s salaries. However, in the following months, businesses will be asked to contribute, but employees will continue to receive the 80% of salary.

The steps

- June and July: The government will pay 80% of wages up to a cap of £2,500 as well as employer National Insurance and pension contributions. Employers are not required to pay anything.

- August: The government will pay 80% of wages up to a cap of £2,500. However, employers will pay National Insurance and pension contributions. On average about 5% of the gross employment costs.

- September: The government will pay 70% of wages up to a cap of £2,187.50. Employers will pay National Insurance, pension contributions and 10% of wages to make up 80% total up to a cap of £2,500.

- October: The government will pay 60% of wages up to a cap of £1,875. Employers will pay National Insurance and pension contributions and 20% of wages to make up 80% total up to a cap of £2,500.

Qualifying Dates & Criteria

To enable the introduction of part time furloughing, and support those already furloughed back to work, claims from July onwards are restricted to employers who are currently using the scheme and previously furloughed employees.

The scheme will close to new entrants on 30 June, with the last three-week furloughs before that point commencing on 10 June.

- From 1 July, employers will be able to agree any working arrangements with previously furloughed employees.

- When claiming the CJRS grant for furloughed hours; employers will need to report and claim for a minimum period of a week, for grants to be calculated accurately across working patterns.

- Employers will be required to submit data on the usual hours an employee would be expected to work in a claim period and actual hours worked.

- If an average claim lasted 8 months, the total cost of employer contributions would represent around 5% of the gross employment costs an employer would have incurred had the employee not been furloughed.

Self-Employment Income Support Scheme

- Individuals can continue to apply for the first SEISS grant until 13 July. Under the first grant, eligible individuals can claim a taxable grant worth 80% of their average monthly trading profits, paid out in a single instalment covering three months’ worth of profits, and capped at £7,500 in total. Those eligible have the money paid into their bank account within six working days of completing a claim.

- Applications for the second grant will open in August. Individuals will be able to claim a second taxable grant worth 70% of their average monthly trading profits, paid out in a single instalment covering three months’ worth of profits, and capped at £6,570 in total.

- The eligibility criteria are the same for both grants, and individuals will need to confirm that their business has been adversely affected by coronavirus. An individual does not need to have claimed the first grant to receive the second grant: for example, they may only have been adversely affected by COVID-19 in this later phase. Further guidance on the second grant will be published on Friday 12 June.

- Read the Factsheet for SEISS and CJRS schemes